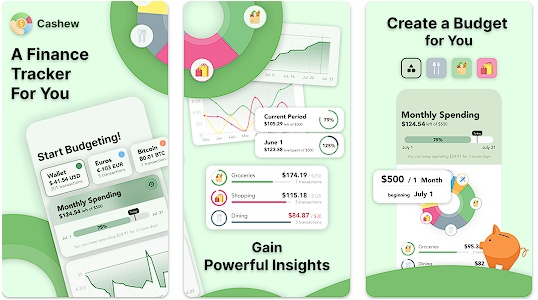

Cashew

Cashew is a slick app for getting a grip on your finances. Created with Flutter tech, it makes managing your money across different gadgets a breeze. Made in September 2021, this app has all sorts of cool tricks up its sleeve.

Budget Power

- Plan Your Spending: You can tailor-make your own budgets for any time frame you like—daily, weekly, monthly, or even just for a weekend getaway.

- Category Caps: Want to set a limit on how much you spend on food or entertainment each month? This feature’s got your back.

- Look Back to Move Forward: With the app, you can pull up your old budgets to see how well you’ve been keeping track of your spending. It’s like your financial yearbook!

- Goal Setting: You’re not just spending; you’re also saving for things like that dream vacation. The app lets you set and track these goals.

Handling Transactions

- Varied Transaction Types: Cashew helps you sort transactions in many ways, whether they’re regular, one-off, debts, or credits.

- Quick Search and Filters: Need to find that particular payment you made last month? Use the app’s search and filter capabilities.

- Bulk Editing: Wanna make changes to multiple budgets at the same time? A simple long-press and swipe does the trick.

- Category & Title Personalization: Make the app yours by creating your own categories and automatically categorizing transactions based on titles you’ve used before.

Currency Juggling

- More than One Account: You can keep tabs on multiple accounts and even multiple currencies, all updated in real-time.

- Switcheroo: You can swap between different accounts and currencies right from the homepage. No sweat.

Keeping It Safe and Easy

- Biometric Locks: Keep your data under wraps with an added layer of biometric security.

- Sign In with Google: Quick and easy login via your Google account. No fuss, no muss.

Design & Usability

- Cool Visuals: The app uses Material You Design, so it looks fresh and modern.

- Interactive Graphs: Understand your money habits better with graphs that actually make sense.

- Light or Dark: Choose between light and dark themes to give your eyes a break.

- Home Screen Tweaks: You decide what info shows up on your home screen. Your app, your rules.

Backup & Automation

- Stay in Sync: Your budget data is available on all your devices, so you’re always in the loop.

- Google Drive Backup: Store your budget data safely in Google Drive, so you don’t lose it.

- Smart Notifications: Get nudged about important money matters, so nothing slips through the cracks.

- Import with Ease: Got your financial data in a CSV file or Google Sheet? Import it effortlessly.